Top 13 Budget Management Apps for Your Business

Top 13 Budget Management Apps for Your Business

Usually, you have many expenses in business that you need to perform daily. Tracking expenses every day and making sure they are within a budget is quite chaotic.

Most of the time, you need to hire financial personnel to look after such expenses and prepare your business budget.

However, hiring separate personnel for managing a business’s financial resources can cost a lot, especially if you have a small business.

Instead, you can use budget management apps/tools to prepare a budget for your business and track your business’s income and expenses.

Budget management apps work as a financial manager who can manage the financial resources of your business.

You can track your business expenses from anywhere and at any time. These apps are less costly than hiring a financial manager.

There are many budget management apps/tools that you can use to manage your business’s budget. Some of the best budget management apps/tools that you can choose for your business are:

Budget Management Apps For Your Business

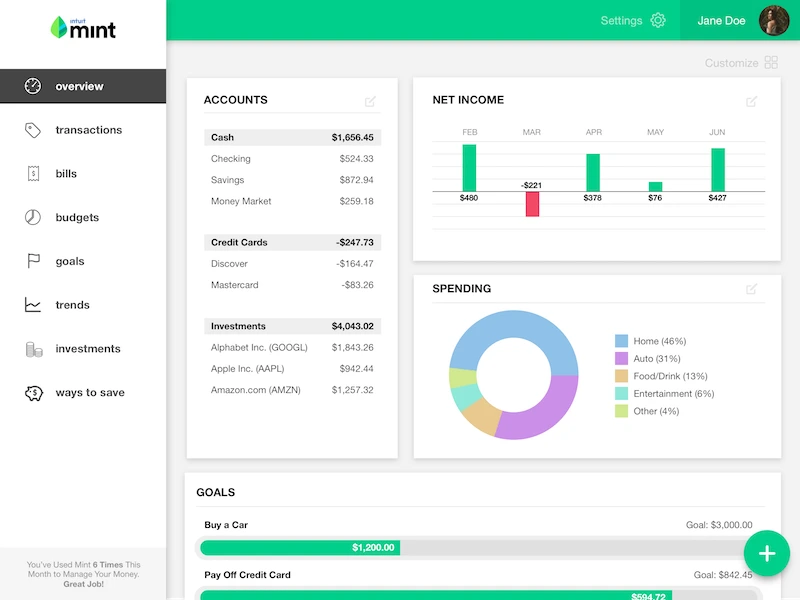

Mint: Money Manager

Mint is simple web-based budget management and tracking tool that effortlessly manages your budget and financial activities.

It allows you to connect with your bank account, credit card, and other financial accounts and collect financial data.

Mint helps you create a budget for your business, stick to the budget, and manage all your bills in one place.

One of the exciting features is that it lets you know when you make expenditures over your budget.

It keeps track of your banks and credit of the financial activities and keeps track of your cash and ATM transactions to ensure that you do not overspend.

Using the app, you can create a goal to save for future use like education, home, business expansion, and more. You are motivated to save more and spend less on unnecessary expenses by creating goals.

The app even alerts you when your business has unusual or significant expenses. Also, if you have recurring bills, it sends your reminder about such bills.

Feature of Mint

- Tracks all your bill in a single dashboard.

- Sends alter for your due bills to make sure that you won’t miss any bills.

- Provides a graph to let you know your remaining budget.

- Allow you to customize the budget by adding tags to the budget.

- Provides security features by providing Touch-ID or code features.

Benefits of Mint

- There is no hidden cost, and it is free to use.

- Send you to alert via email or SMS.

- Tracks your credit score.

Drawbacks of Mint

- Difficult to reconcile financial reports.

Pricing of Mint

Mint is free of cost.

Available on: Android, IOS, Web.

PocketGuard

PocketGuard is a financial management and budgeting app that helps you manage your business budget better. You can view your monthly budget, track bills, split transactions, and manage the budget.

It is suitable for personal use and small business where you do not have a large financial transaction daily.

The app creates your budget based on your past financial transactions and encourages you to save. It also creates a pie chart for all your expenses, making it easier to view all your costs in a single graph.

Best Math Apps for Android can also help improve your business skills by enhancing your mathematical abilities, which are crucial for effective budgeting and financial management.

PocketGuard aims at increasing your savings and helps to reduce expenses by setting spending capacity in each overhead.

The app provides you with a PIN code and biometric to provide additional security features.

Features of PocketGuard

- Allow you to set a goal and meet the goal.

- Keeps a record of your expenses made by both cash and by bank or credit card.

- Provides you with information about your remaining budget in the graph.

- Creates a budget based on past financial transactions.

- Easy to identify unwanted expenses.

Benefits of PocketGuard

- The app provides a high-security feature that makes the app secure to use.

- Provides an excellent alert system.

- Allow you to sync with your financial accounts.

Drawbacks of PocketGuard

- It is available in the USA and Canada only.

Pricing of PocketGuard

There are two pricing plans for PocketGuard, which are:

- PocketGuard Basic: It is free of cost.

- PocketGuard Plus: It costs $3.99 per month.

Available on: Android, IOS, Web.

Goodbudget

Goodbudget is a budgeting app that manages your budget tracks debts and money. The app provides you with a separate envelope for spending and saving categories.

It works as a digital envelope where you can manually add a budget, or the app creates a budget based on your past transaction.

An envelope for each overhead is created, and you add a budget to the overhead. When you need to make expenses on a particular overhead, you take money from the envelope and spend it.

Once your envelope is empty, you cannot spend on the overhead further until you create a new budget. Create an envelope based on the budget period.

However, you cannot sync with your bank or credit institution in this app.

Feature of Goodbudget

- Provides you with past expenditure data.

- Allow you to use the app from multiple devices.

- View your expenditure on the pie chart.

- Allow you to share your budget.

- Allow you to split expenses only with two envelopes.

Benefits of Goodbudget

- Has a simple user interface that makes the app easy to use.

- Provide historical expenses over more than one year.

Drawbacks of Goodbudget

- Does not sync with financial institutions.

- Does not provide other financial reports.

Pricing of Goodbudget

Goodbudget provides two pricing plans, which are:

- Goodbudget Free: It is free forever.

- Goodbudget Plus: It costs $7 per month.

Available on: Android, IOS, Web.

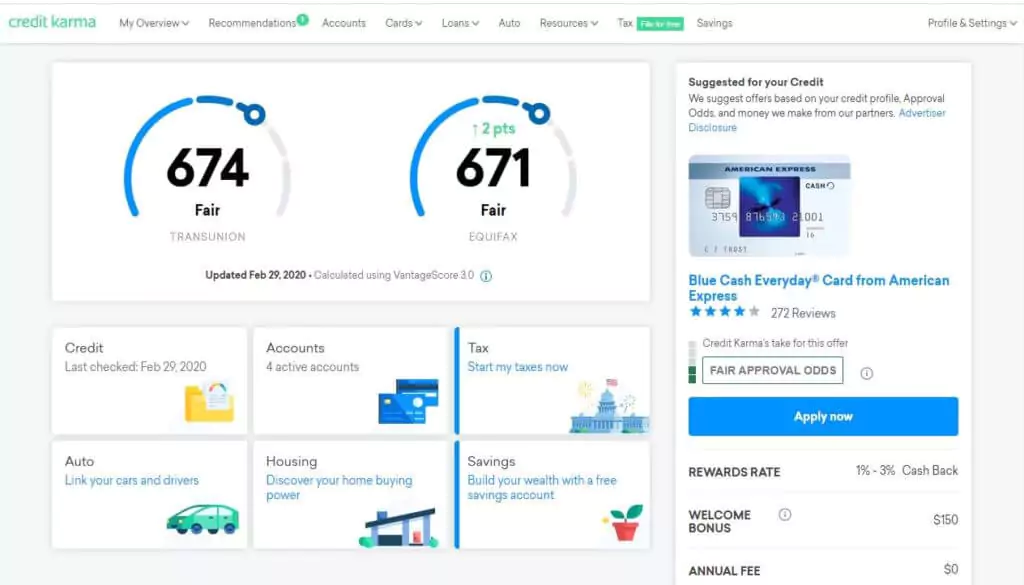

Credit Karma

Credit Karma is a free credit monitoring and financial website that offers your credit score and reports.

It helps you manage your loan and credits and helps your business make economic progress.

It also calculates your simple loan, amortization, debt, and more. The app monitors your report and sends you an alert when there are some changes in the report.

It provides a graph showing the credit score and compares it with previous data. All this information is displayed on the dashboard. It is a highly secure app and ensures your data are always private.

Features of Credit Karma

- Work as a financial calculator to calculate your debt, loan, mortgage, and more.

- Provides a two-factor authentication feature.

- Ensure the privacy of your data.

- Sends you an alert notification if your data are exposed.

- Provides auto loan feature to calculate your loan.

Benefits of Credit Karma

- It is free of cost.

- Ensure data privacy.

- Easy to set up.

Drawbacks of Credit Karma

- Does not provide information regarding saving and over budgeting.

Pricing of Credit Karma

It is free of cost.

Available on: Android, IOS, Web.

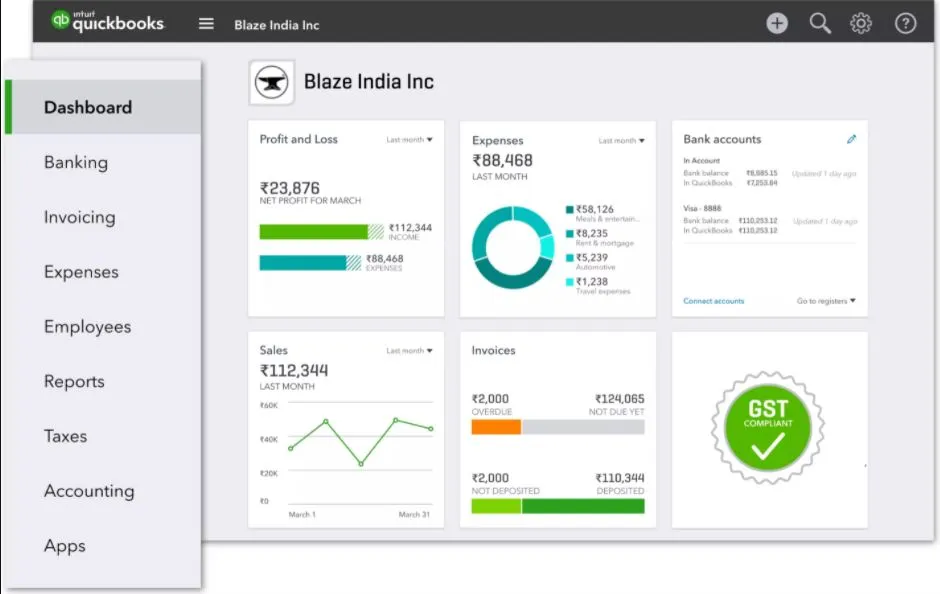

QuickBooks

QuickBooks is a cloud-based accounting software package suitable for small and mid-sized businesses. It helps keep track of the income and expenses and manage the business’s finance.

It helps you manage sales and income to generate bills payable, invoices and create reports. You can also keep track of bills and expenses, generate profit and loss reports, and prepare tax reports.

You can connect QuickBooks with your financial institution and make e-payment through the app.

It helps you track your inventory, billable hours by clients or employees, mileage tracking, etc.

You can even integrate the app with TSheet, BigTime, Gusto, Fathom, etc.

Feature of QuickBooks

- Track income and expenses to know where you are having over expenses.

- Manage your income and expenses to minimize tax.

- It helps to track your VAT.

- Allow you to track projects and manage employees.

- Customize reports based on your requirement.

Benefits of QuickBooks

- Has a multicurrency feature.

- Has an excellent user interface.

- It helps you to manage 1099 contractors.

Drawbacks of QuickBooks

- The online documentation feature needs to be improved.

Pricing of QuickBooks

Quickbooks offers four plans, which are:

- Simple Start: It costs $12.50 per month.

- Plus: It costs $34 per month.

- Advanced: It costs $75 per month.

- Self-Employed: It costs $75.50 per month.

Available on: Windows, Mac, Android, IOS.

Wally

Wally is a budget and financial management app that keeps track of your expenses and controls your finances. It tracks all your income and expenses and presents them in a graph.

Use Wally’s budgeting tool to customize your budget and control your monthly expenses and savings.

It keeps track of the total amount you spent on your budget and how much you can further spend during a month.

You can connect the app with your financial institution and view the last six months’ transactions. View your expenses in the pie chart and determine overheads with more expenditure.

Feature of Wally

- It offers a multi-currencies feature, which comes in handy when you have customers from all around the world.

- Allow you to integrate the app with your bank account.

- Download your report in CSV and Excel files.

- View all your transactions in real-time.

- Schedule your upcoming payments.

Benefits of Wally

- Easy to use.

- Provides a graphical view of your expenditure.

Drawback of Wally

- More features need to be added.

Pricing of Wally

Wally is free of cost.

Available on: IOS.

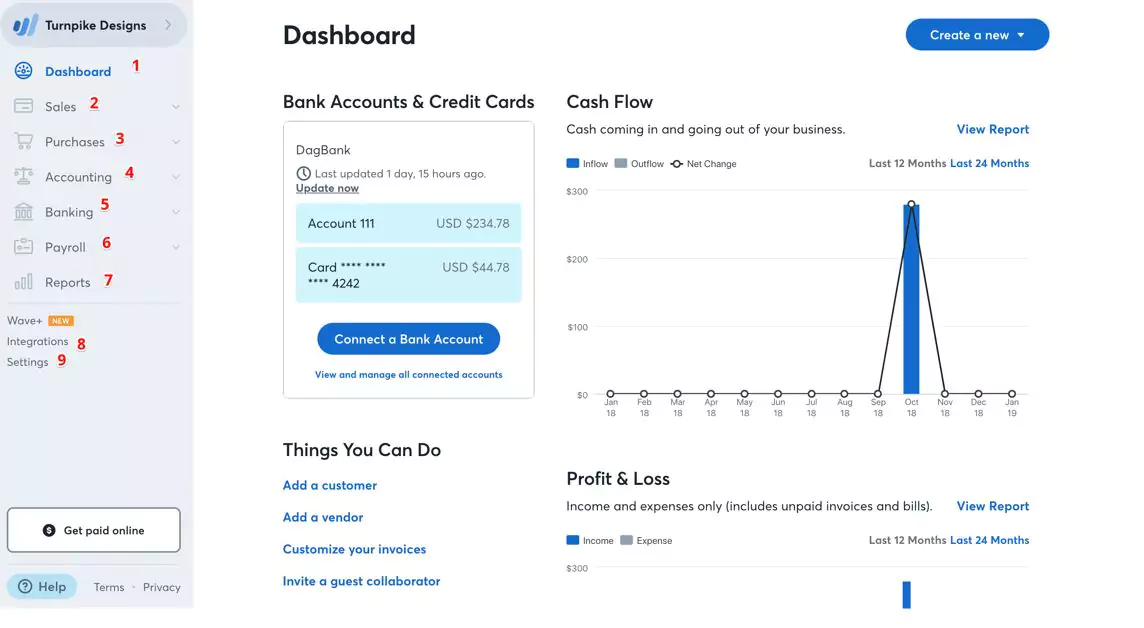

Wave

A wave is an accounting software suitable for small businesses, freelancers, and customers. Using Wave, you can manage your account, invoices, payment, payroll, and more. Track your business income and expenses and simplify the process.

It allows you to create professional invoices using invoicing templates for your business and export them in Excel, Word Docs, PDF, Google Docs, and Google Sheet. Receive and send the invoice to customers using email.

One of the best features is that it allows you to add unlimited partners, accountants, and more. It helps manage and save your recurring bills and automates the payment method.

You can view your invoices, bills, banking transaction, net income, and loss in the dashboard. Use the chart and graph to get a clear idea about business progress.

Features of Wave

- Allow you to add templates and customize invoices.

- Has a multicurrency feature.

- Allow you to sync with multiple banks.

- Provides a user-friendly dashboard to provide you quick insight into your business.

- Has the client portal feature, which allows clients to view their invoices online.

Benefits of Wave

- It is free of cost.

- It is user-friendly and easy to use.

- Automatically creates an invoice for your business.

Drawbacks of Wave

- The app is relatively slow.

- Has a limited feature.

Pricing of Wave

Wave is free of cost; there is no hidden cost and limitation while using the app.

Available on: Windows, Mac, Android, IOS, Web.

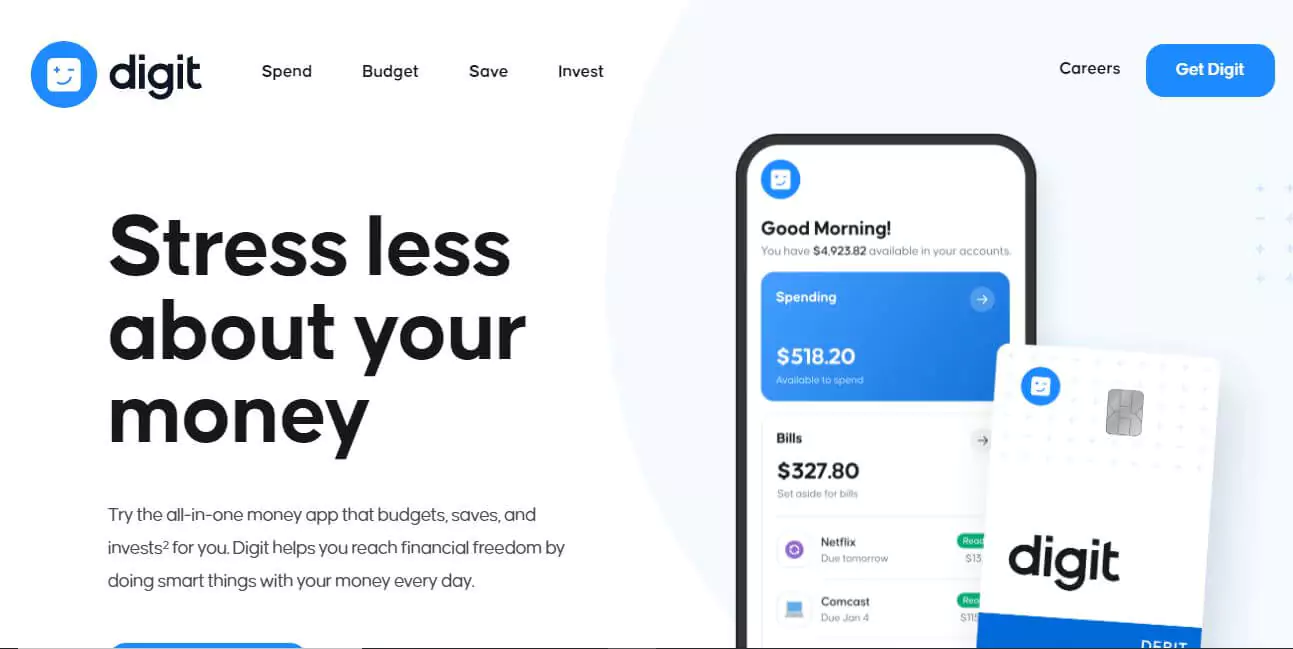

Digit

Digit is a financial app that helps you save by analyzing your balance, upcoming expenses, and income and exploring the amount for saving.

The app automatically transfers some cash to the Digit account at some weeks intervals to help you save. The app itself decides amounts that need to be saved based on past expenses.

Using Digit, you can share what you are saving with others and allow you to save for multiple purposes at a time. It also sends you text messages to notify you of your saved total amount.

The app does not work with credit cards; however, expenses made on those cards are shown on your expenses.

Features of Digit

- Allow you to save for unlimited goals.

- Provides chatbot features.

- Withdraw your money anytime.

- It has an automatic saving feature, which automatically saves money.

- Provides you with a bonus of 0.5% every three months of saving.

Benefits of Digit

- Provides you with a bonus on saving.

- Allow you to save as much as you want.

- Helps to pay the debt quickly.

Drawbacks of Digit

- Does not provide an accurate picture of expenses made using a credit card.

Pricing of Digit

Digit costs $5 per month.

Available on: Android, IOS, Web

Toshl

Toshl is a finance app for budget management and expenditure tracking, sets the budget, and helps you save. It syncs with your financial institutions to track your expenses and income.

The app creates a budget for your business to ensure you have extra cash by the end of the month.

Get details on overhead where you spend throughout the month and determine which overhead had the most expenses and less.

You can set a specific budget for each overhead, and when you spend more than required, the app will send you a notification.

Feature of Toshl

- Provides a multicurrency feature.

- Allow you to export reports and data in CSV, PDF, Excel, Google, and Evernote format.

- Sends reminders about upcoming expenses.

- Provide security features.

- Allow you to add data manually.

Benefits of Toshl

- Easy to use.

- It is mobile compatible.

Drawbacks of Toshl

- They have a limited integration facility

Pricing of Toshl

Toshl offers three plans, which are:

- Toshl Free: It is free of cost.

- Toshl Pro: It costs $3.33 per month.

- Toshl Medici: It costs $3.33 per month.

Available on: Android, IOS, Web.

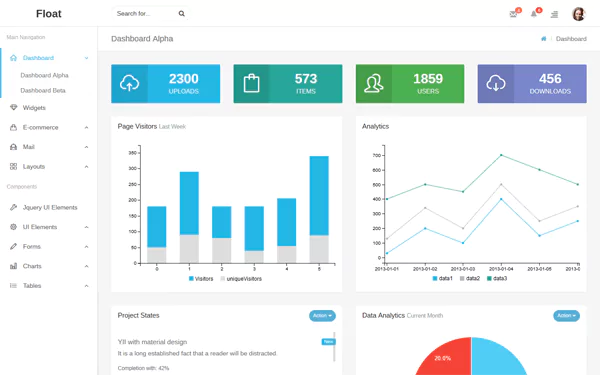

Float

Float is cash management and budgeting management app for the firm’s bookkeeping and accounting system.

It provides you with detail on the cash flow of your business and allows you to view multiple budgets accurately.

It creates a projection of expenses and bills and compares them with actual costs. The app even creates a graph for estimated expenses and allows you to import the chart in PDF and CSV format.

Compare your estimated budget with an actual budget and get detailed insight into actual cash in and out. You can forecast your business budget for three years using the app.

The app sends you a weekly cash summary, free staff training, and email support systems.

Features of Float

- Provides a free staff training facility.

- Allow you to add a minimum of five scenarios.

- Offers email support feature.

- Allow you to export and share financial reports.

- Predicts the business budget for the next three years.

Benefits of Float

- Prepares budget for three years.

- Provides a user-friendly interface.

- Allow you to create a scenario.

Drawbacks of Float

- Suitable only for small businesses.

- It is quite expensive.

Pricing of Float

Float offers three plans, which are:

- Essential Plan: It costs £39 billed monthly.

- Premium Plan: It costs £79 billed monthly.

- Enterprise Plan: It costs £165 billed monthly.

Available on: Windows, Mac, Web.

Maxiplan

Maxiplan is a web-based budget planning and forecasting app suitable for small and mid-sized businesses.

It helps you create a balance sheet, profit, and loss statement and prepare a financial report.

The app helps you create a budget for your business and provides in-depth analysis and reporting. It reduces the burden for financial personnel by reducing errors in financial statements.

It is a cost-effective solution to reduce the budget and make accounting and financial processes error-free.

Prepares a dynamic interactive report and shows the report in the dashboard. Ensure the report’s privacy and allow you to view information only to those who have access to view the report.

Features of Maxiplan

- Creates a dynamic report.

- Prepare a budget for the upcoming year based on the balance sheet report.

- Has a multicurrency feature.

- Ensure transparency of financial statements.

- Supports multiple accounting systems.

Benefits of Maxiplan

- Forcast budget based on the financial report.

- Provides support 24/7.

- Has features like “what i” scenarios.

Drawbacks of Maxiplan

- Not suitable for a large business.

Pricing of Maxiplan

It is free of cost.

Available on: Windows, Mac, Android, IOS, Web.

Tidemark

Tidemark is a financial and operational planning software for budget planning and result tracking. It tracks both financial and non-financial measures of your business.

It makes workflow smooth and helps to automate planned tasks and minimize errors. The app is useful for managing the supply chain, revenue planning, budgets, forecast, etc.

It provides a dynamic modeling feature for computation, compares what-if analysis, and more.

Features of Tidemark

- Provides a what-if analysis scenario.

- Provides dynamic modeling feature.

- View data in the graph.

- Allow you to transfer funds to different bank accounts.

- Allow you to set an alert.

Benefits of Tidemark

- Has multi currency features.

- Easy to use.

Drawbacks of Tidemark

- Limited features are available.

Pricing of Tidemark

N/A.

Available on: Windows, Android, IOS, Web.

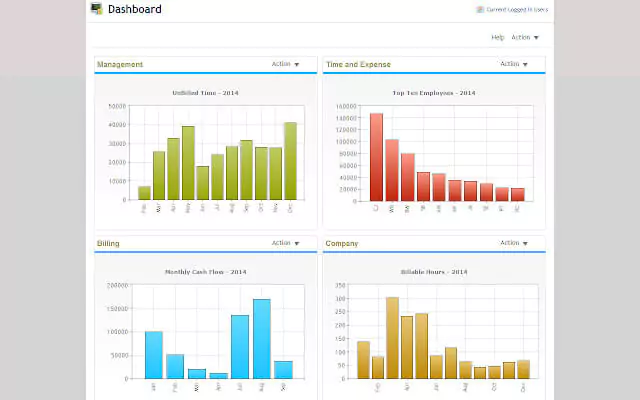

BillQuick

BillQuick is an accounting, billing, and time tracking software for small and mid-sized businesses. It helps the company to manage resources and allows you to color-code tasks and events in the calendar.

You can view your project status on your timesheet and monitor employees’ time using the calendar feature.

Using the app, you can estimate your project budget, calculate total income, estimate project time, etc.

It shows your payment history account notes and tracks multiple entries in single accounting files.

Features of BillQuick

- Tracks your bills and expenses.

- Allow you to view your payment history.

- Has a time card option.

- Provides resources management and budget management features.

- Allow you to manage your invoices.

Benefits of BillQuick

- Provides many features.

- It’s a cross-platform app.

- Allow you to track the time spent by employees on their work.

Drawbacks of BillQuick

- The user interface can be better.

Pricing of BillQuick

BillQuick offers two plans, which are:

- Professional Plan: It costs $19.95 per month per user.

- Enterprise Plan: It costs $24.95 per month per user.

Available on: Windows, Linux, Mac, Android, IOS, Windows phone, Web.

Importance of Budget Management Apps

Minimize Error

While calculating financial statements and budgets in business, we tend to make errors when the calculation process is done manually.

Therefore, you should use a budget management app to reduce calculation errors. These apps can calculate your financial statements without errors unless we give false input; these apps ensure the calculation is 100% accurate.

Helps You To Stick With The Budget

When you create a budget manually, sticking to the budget can be difficult since the manual budget doesn’t notify you when you spend more than the budget you created.

The budget management apps send you notifications and alert messages when you spend more than you allocated for overhead expenses.

These apps keep track of your recurring expenses and create a budget as per historical expenses. This helps minimize unwanted costs, increases your saving, and quickly reaches your financial goal.

Help To Meet Your Financial Goal.

Every business sets a specific financial goal and wants to meet the goal within a certain period.

It is always better for businesses to create a budget and move along with the budget to meet the financial goal.

When companies fail to spend according to their budget, it becomes difficult to manage their expenses and meet the goal within the specified time.

If you have to travel a lot and cannot spend more time in business, it is always better for you to use a budgeting app for your business.

In this way, manage your business financial resources even if you do not visit your company regularly and meet your goal within the specified time.

Auto Calculates Your Financial Statement

Usually, separate financial personnel is hired to finance your business in business. You need to pay extra for financial personnel, and also, the calculation process of financial statements can take a long time.

One of the advantages of a budget management app is that it automatically calculates your financial statements like profit and loss account, general ledger, balance sheet, and more.

All the income and expenses transaction is recorded in the app and automatically calculate your business’s profit and loss.

Reminds You About Your Recurring Bills

All your bills are listed in the budgeting app, and it identifies your recurring bills. During budget creation, the budget for your regular bills is made.

Also, some budgeting apps remind you about recurring bills by sending you a notification about the bills.

This reminder will help you pay all your bills at the specified time and ensure that you are never late for paying your bills.

Conclusion

An effective budget management tool helps you manage your business’s financial activities and enables you to reduce work pressures. You can control the financial resource of your business without any stress and hassle.

The right budget management tool makes financial resources management tasks effortless. In most cases, it also helps reduce your business’s operating costs.

There are many budget management apps; here, I have mentioned some of the best budget management apps you can choose for your business.

If you feel I have missed some more apps, please mention them in the comment section below.

in Melbourne

in Melbourne

Employee Screen Monitoring Software

Employee Screen Monitoring Software App and Website Monitoring Software

App and Website Monitoring Software Time and Attendance Software

Time and Attendance Software Finance

Finance Banking

Banking Healthcare

Healthcare Lawyers

Lawyers Retail & ecommerce

Retail & ecommerce Knowledge base

Knowledge base Blogs

Blogs Installation Guide

Installation Guide FAQs

FAQs About

About Media Kit

Media Kit Contact us

Contact us