<strong>Exempt Vs Nonexempt Employee: Differences and Fully Comparison </strong>

Exempt Vs Nonexempt Employee: Differences and Fully Comparison

Employees desire a salary that is compatible with their abilities. In turn, employees want to remain protected from penalties and fines. Wouldn’t it be great if you could have the best of both worlds? For this, you need to distinguish exempt employees from nonexempt employees; after that, you can classify your employees accordingly.

This will ensure your employees receive the wages they deserve while avoiding penalties for misclassification. It’s a win-win situation for both sides. Also, employers must understand the difference between exempt and non-exempt jobs in order to establish appropriate guidelines regarding overtime compensation and other issues.

Now, the question is how to classify the employees as exempt and nonexempt and what the differences are.

What is an Exempt Employee?

Exempt employees are those who are not covered by the FLSA and are not entitled to overtime compensation under that law. They are excluded from

- Paying minimum wages,

- Regulations on overtime,

- Protections and rights offered to nonexempt workers

Exempt positions require employers to pay salaries, rather than hourly wages. Exempt employees work more than 40 hours per week. However, this requirement cannot be overridden just because an employer does not want to pay overtime.

Three basic things can make an employee “exempt”.

- A fixed salary is paid to an exempt employee.

- Their salary must be equal to or greater than the FLSA salary limit.

- The employees must satisfy the job requirements to receive the salary stated.

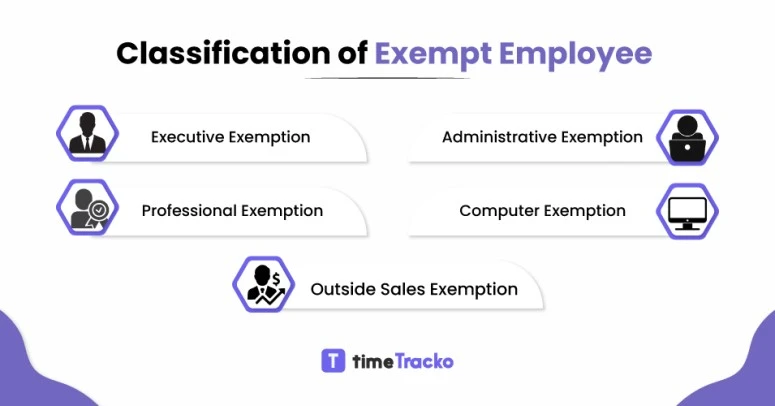

Classification of Exempt Employee

Exemptions usually only apply to executive, supervisory, professional, or outside sales positions.

- Executive Exemption

To be an executive exemption,

- The employee must oversee at least two or more full-time employees or four or more full-time employees as a regular part of their work duties.

- They are also responsible for at least one aspect of the organisation’s business and may be involved in the hiring process to some extent.

Exemptions for executive roles include CEOs, mid-level managers, and shift supervisors.

- Administrative Exemption

To be an administrative exemption,

- They should be directly involved in the management of the organisation.

- They are responsible for making important business decisions without being accountable to anyone else.

Exemptions for administrative roles include in-house accountant and human resource manager.

- Professional Exemption

To be a professional exemption,

- The employee should be trained in a particular area or have a particular area of specialisation.

- They should hold a college degree or professional degree in their particular field.

Exemptions for professional roles include doctors, teachers, lawyers, and certified public accountants.

- Computer Exemption

To be a computer exemption,

- The worker must fulfil the requirements for exemption and work in computer-related or information technology-related positions.

Exemptions for computer roles include skilled computer programmers, computer system analysts, and software system designers.

- Outside Sales Exemption

To be an outside sales exemption,

- It is their responsibility to procure contracts from outside or make sales.

- The nature of their work takes them outside the organisation’s four walls.

Exemptions for outside sales roles include salespeople and marketers.

What is a Nonexempt Employee?

The term “non-exempt employee” refers to someone who does not qualify for exemption from the Fair Labor Standards Act, who receives at least the federal minimum wage per hour they work, and who receives 1.5 times what they are paid for overtime.

Nonexempt is the opposite of exempt. These employees receive overtime pay. If an employee works more than 40 hours per week, they are generally entitled to overtime pay and the minimum wage.

To be nonexempt employees, they should meet at least one of the following:

- Paid hourly

- Has earnings under the exempt threshold of $35,568 (or $684 per week)

- Not involved in executive, administrative, or professional job duties

Contractors, freelancers, interns, servers, retail associates, and similar workers fall into this category.

Requirements For Exempt vs Nonexempt Employee

There are some requirements that determined whether employees fall under the category of exempt or nonexempt.

Requirements For Exempt Employee

To qualify as an exempt employee, employees must meet three key criteria, including

- Salary Payment

People who are exempt earn salaries rather than hourly wages, so they qualify for exempt status if their monthly salary exceeds the FLSA minimum threshold, regardless of how many hours they work per week.

- Total Earning

To be exempt, employees must meet the FLSA’s salary threshold. The FLSA’s salary thresholds change every year, so it’s important to stay current on the rules. The minimum salary for exempt status in 2020 is $445 per week or $23,600 per year. Employees earning less than these amounts will be non-exempt.

- Job Duties

The exemption generally applies to employees who hold professional positions requiring a high level of knowledge and expertise on top of meeting the salary requirements.

Requirements For Nonexempt Employee

To qualify as a nonexempt employee, employees must meet three key criteria, including

- Salary Payment

Nonexempt employees receive hourly wages, plus 1.5 times their hourly rate for overtime, but not a monthly salary as per the FLSA.

- Total Earning

FLSA defines nonexempt employees as those who earn less than $23,600 per year (or $445 per week).

- Job Duties

Jobs that earn a minimum wage but do not qualify for exempt status fall under the category of non-exempt jobs.

Differences Between Exempt Employee and Nonexempt Employee

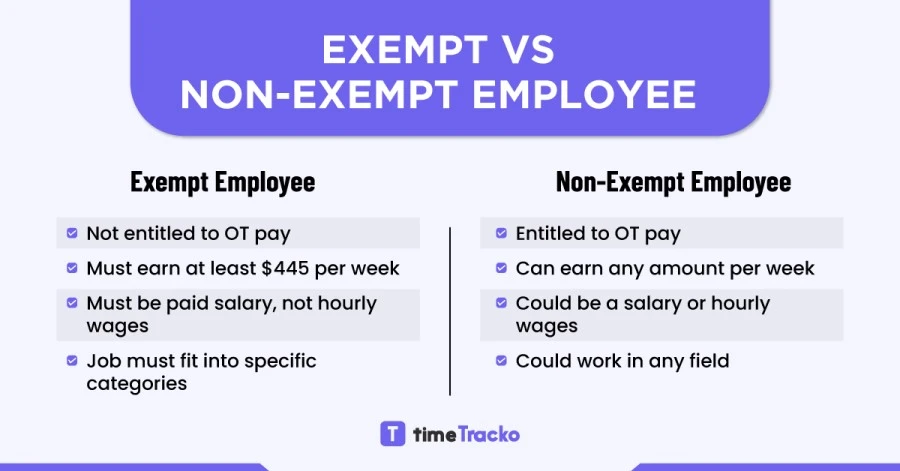

Employees are classified into exempt and non-exempt categories based on the following parameter. One of the biggest differences between exempt and nonexempt employees is: Exempt employees do not have to be paid overtime.

1. How much they are paid:

Workers who earn $23,600 per year or $445 per week, or more than the FLSA salary limit set, are considered “exempt” under the FLSA.

Workers who receive hourly wages rather than a fixed monthly salary or less than the FLSA salary limit set are considered “non-exempt” under the FLSA.

2. How they are paid:

The employee must earn a guaranteed minimum salary to qualify as “exempt”. Employees with exempt status must receive a fixed monthly salary regardless of how much overtime they work.

An employee who receives overtime pay is considered a “non-exempt” employee, i.e., they are entitled to overtime pay if they work more than 40 hours in a week.

3. What kind of work they do:

Those who perform executive, professional, or administrative tasks are defined as “exempt” employees under the Fair Labor Standards Act (FLSA).

Employees who qualify as nonexempt must also perform “non-exempt” duties. These duties include freelancers, interns, servers, retail associates, and similar workers.

How does Fair Labor Standards Act (FLSA) affect employee exemption status?

In 1938, the FLSA introduced the exempt employee category, which protected workers against unfair labour practices. Even though the law has changed drastically in the last 80 years, it is still one of America’s most important labour laws, setting rules on a range of employee- and employer-related matters.

FLSA specifies the circumstances under which workers should or should not be paid. For instance, if an exempt employee works more than the required number of hours, he does not receive overtime pay.

In accordance with the law, overtime is defined as any hours over 40 in a seven-day work week that is not credited to the employee’s regular rate of pay and overtime pay is generally 1.5 times the employee’s regular salary.

What Are The Pros and Cons of Exempt Employee and Nonexempt Employee

Understanding the differences is important, but also understanding how both of these systems have advantages and disadvantages is equally important. Furthermore, you should know the pros and cons of different jobs so you can make a decision based on both legal and nonlegal information.

Pros and Cons of Exempt Employee

The pros are as follows:

- You can get the employees to perform certain job responsibilities for a fixed salary, and they are accountable for them.

- Companies have fixed costs associated with the salaries of exempt employees.

- It provides employment security as well as a static career path for employees.

The cons are as follows:

- Exempt employees enjoy fewer benefits than non-exempt employees, which is a significant disadvantage from the employee’s point of view.

- Exempt employees, by contrast, are usually more costly for businesses since they must exercise authority and judgment to do their jobs.

Pros and Cons of Nonexempt Employee

The pros of hiring a non-exempt employee are as follows:

- As non-exempt employees have a fixed salary, fixed hours, and a certain level of quality and quantity of work, they are flexible to the organization.

- When it comes to employee compensation, you pay them based on the actual work they perform, and if they go a little overboard, you pay them overtime.

The cons of hiring a non-exempt employee are as follows:

- The lack of consistency can be a drawback for both employers and employees.

- Employees who are not exempt do not have the same level of security and stability as exempt employees.

Conclusion

As soon as you hire employees, you should classify them as exempt or nonexempt. That way, you will maintain FLSA compliance with your payroll reporting. You will also prevent errors in the way employees calculate their hours.

You should use timesheets for nonexempt employees to track their hours and overtime they work, as well as for exempt employees to account for paid leave (if applicable).

FAQs

Q1) Does an exempt employee have to work 40 hours a week?

Many companies require their exempt employees to work a 40-hour workweek, but that’s not always the case.

Q2) Can exempt employees get overtime?

Due to their type of work and pay, exempt employees do not have the right to overtime.

Q3) What is salaried non-exempt?

Employees who receive a salary but do not qualify for exemption are classified as salaried non-exempt employees.

Q4) How many hours can a salaried exempt employee be forced to work?

As per the law, there is no limit on the number of hours an exempt worker can work per week. Exempt employees could therefore be forced to work substantially more than 40 hours per week without being compensated for overtime.

in Melbourne

in Melbourne

Employee Screen Monitoring Software

Employee Screen Monitoring Software App and Website Monitoring Software

App and Website Monitoring Software Time and Attendance Software

Time and Attendance Software Finance

Finance Banking

Banking Healthcare

Healthcare Lawyers

Lawyers Retail & ecommerce

Retail & ecommerce Knowledge base

Knowledge base Blogs

Blogs Installation Guide

Installation Guide FAQs

FAQs About

About Media Kit

Media Kit Contact us

Contact us