Best Payroll Management Software For Your Business

Best Payroll Management Software For Your Business

One of the most time-consuming and expensive elements of running a business is payroll. Payroll management is one of the most critical roles of HR managers.

When a company’s staff expands in size, it can be challenging to keep track of work hours and ensure that all employees receive their payments on time.

A payroll software system automates the whole payroll process, allowing you to focus on essential HR functions.

Payroll software automates all aspects of the payroll process for small and big enterprises. It assists you in managing employee payments by making it simple to set up direct deposits, withhold payroll taxes, and maintain accurate records.

Payroll management is a sensitive task for every business. Tracking and handling the employee’s hours is quite challenging until you use some payroll management tools.

This article has discussed the best payroll management software that suits your business.

Benefits of Payroll Management Software

Many businesses prefer payroll software to manual processing because it allows them to:

- Perform payroll computations and deductions more quickly.

- Provides accurate payslips.

- Calculate bonuses, costs, holiday pay, and so on with the least amount of effort.

- It saves time and money since it is an automated system.

- It enables timely reporting.

- It reduces the burden of compliance.

- It obviates the need to understand complicated tax law.

- Helps to store reports, payslips, and other data securely for further use.

We have examined different payroll systems to assist you in selecting the best payroll software for your company.

We considered price, simplicity of use, critical integrations, convenience, reporting features, and support.

Best Payroll Management Software for Your Business

Here I have discussed some of the best payroll management software that helps your business to operate effectively.

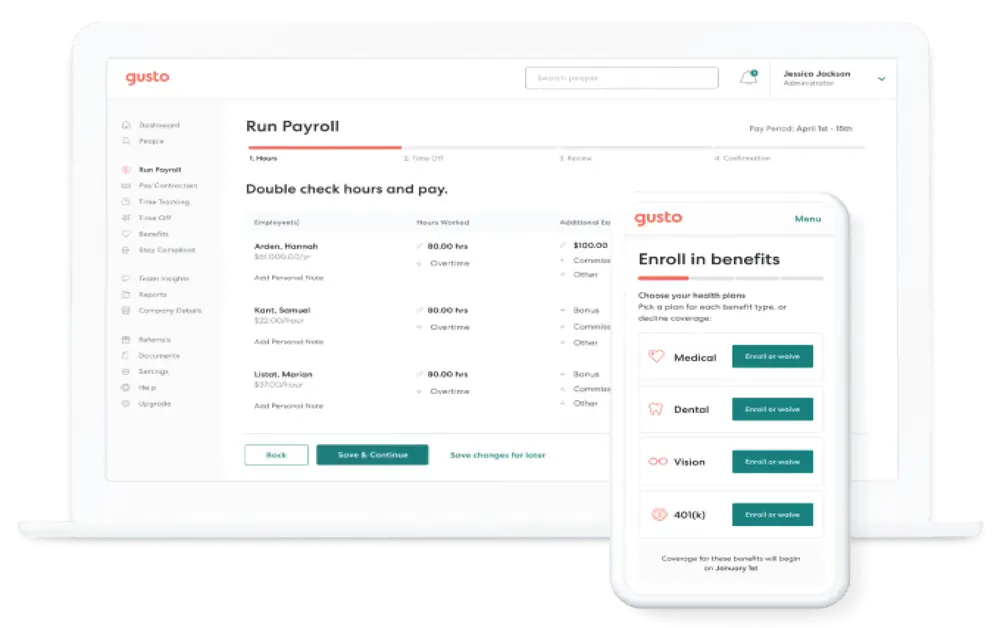

Gusto

Gusto is a cutting-edge online people platform that assists small businesses in managing their staff.

Gusto’s headquarters are in Denver, San Francisco, and New York now service over 100,000 businesses across the country.

Gusto allows you to pay your employees by direct deposit or cheques like other payroll software systems. It also automatically records and submits federal, state, and municipal taxes. Gusto differs from the other alternatives because it provides a better plan with each tier.

Gusto is a full-service payroll, HR, and Benefits platform that serves over 100,000 small companies throughout the US. Gusto offers employee benefit plan options in over 38 states. Gusto is also an entirely cloud-based service with software integrations with Xero and QuickBooks.

Gusto can be broken down into four different parts:

- Onboarding

- Getting Paid

- Benefits

- Customer Support

Gusto provides health insurance, 401(k)s, skilled HR, team management tools, and full-service payroll.

Features of Gusto

Some of the best features of Gusto payroll are as follows:

- Reporting and Dashboards

- User, Role, and Access Management

- Time-tracking Integrations

- Integrated pre-tax benefits

- Automated payroll reports

- Integrates with accounting software such as FreshBooks, QuickBooks, and Xero

- Flexible payment schedule

- Paperless paychecks and easy cancellation.

Benefits of Gusto

- User friendly and easy to use.

- Unlimited payroll runs.

- Tracking of paid time off (PTO) is available.

- It has accurate fillings and tax payments.

- Easy and complete reporting.

- Automatically syncs expenses.

Drawbacks of Gusto

- No geo-tracking facility.

- No mobile app

Pricing of Gusto

Gusto is available in three different plans as follows:

- Core ($39/month + $6 per user/month)

- Complete ($39/month + $12 per user/month)

- Concierge ($149/month + $12 per user/month)

Availability: Mac OS, Web Browser, Windows.

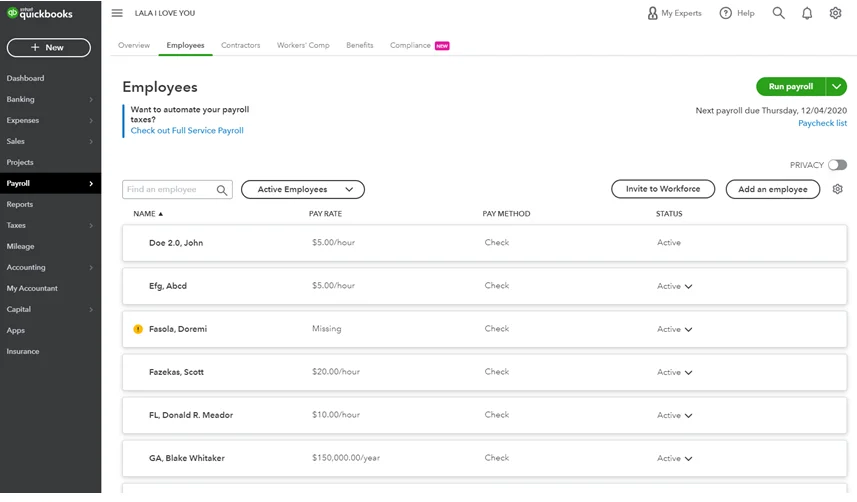

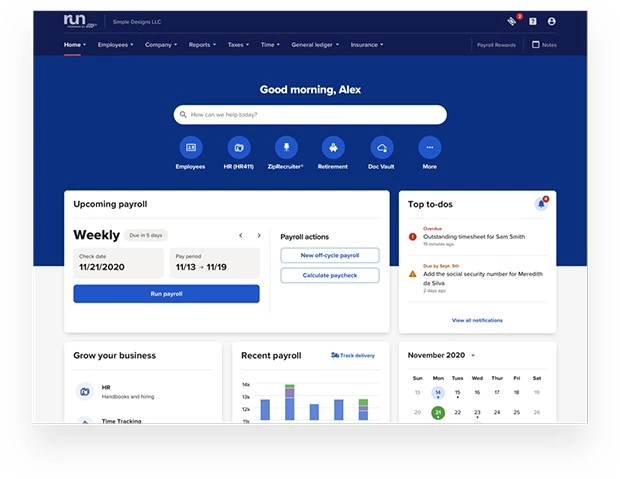

QuickBooks Payroll

QuickBooks Payroll is a technology-enabled HR services platform that provides small businesses with human resource (HR) and personnel management services.

It assists organizations in managing procedures for onboarding, salary calculation, attendance monitoring, and benefits administration for customers across several geographical locations.

QuickBooks Payroll is a beautiful alternative for large businesses that want a full-service payroll solution or require assistance setting up payroll.

It interacts with your existing platform; it is an excellent choice for organizations currently utilizing QuickBooks accounting software.

Features of QuickBooks Payroll

Here are some of the best features of QuickBooks payroll.

- Automatic payroll updates

- Create paychecks with automatic tax calculations.

- Direct deposit for employees and 1099 contractors

- E-file and E-pay

- Easy expert support

- Client-ready payroll reports.

- Federal forms and state forms

Benefits of QuickBooks Payroll

- Simple installation and an easy-to-use interface

- QuickBooks accounting software connection is seamless.

- Options for quick, direct deposits

- Process payroll and prepare payroll taxes

- Handles employees information

Drawbacks of QuickBooks Payroll

- Tax filing is not included in the entry-level plan.

- Filing Form 1099 incurs additional fees.

Pricing of QuickBooks Payroll

QuickBooks Payroll is available in three different plans as follows:

- Core: It costs $22/month.

- Premium: It costs $37/month.

- Elite: It costs $62/month.

Availability: Mac os, Windows

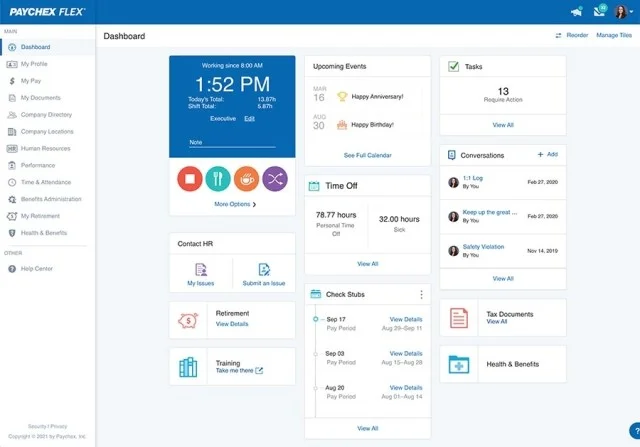

Paychex Flex

Paychex Flex is yet another solution for all things HR, including payroll, time and attendance, benefits, and more.

The Paychex Flex app allows you to manage your business on the go. Paychex Flex makes online payroll flexible and straightforward with an intuitive platform and mobile app.

Paychex Flex provides over 160 reports to help you understand earnings, taxes, turnover, and more. It also automatically submits payroll taxes, provides limitless payroll runs, guarantees compliance, and integrates with other critical tools you use, such as accounting and benefits applications.

It is the top reporting choice since it ticks practically every box for what you’d want in payroll software in terms of reports and data.

The payroll software simplifies the setup and administration of payroll, automates the filing of federal, state, and local payroll taxes, and provides various upgrade choices that you may require as your business expands.

Features of Paychex Flex

Some of the exciting features of Paychex Flex are as follows:

- Online payroll

- Tracks time and attendance

- New-hiring reporting

- Alerts and notifications.

- Mobile app

- Accounting software integrations

- Smart analytics and reporting

Benefits of Paychex Flex

- 24/7 support

- Simple to use

- HR add-on services

- Powerful reporting capabilities

- Notifies HR after new entry and edit functions

Drawbacks of Paychex Flex

- Even the cheapest package is costly.

- Setup and EOY tax documents include hidden costs.

- Mixed review from the user regarding support

Pricing of Paychex Flex

Paychex Flex offers three different plans.

- Paychex Flex Go: ($59/month + $4 per employees)

- Paychex Flex Select: Custom based on your needs

- Paychex Flex Enterprise: Custom based on your needs

Availability: Windows, Mac, Android, web Browser

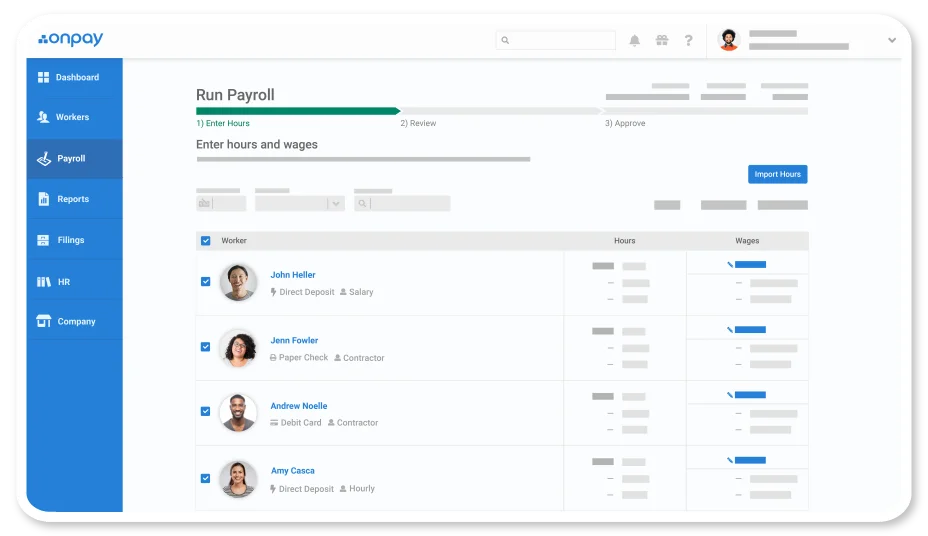

OnPay

OnPay is a cloud-based payroll service that assists small businesses with tax filing and payment workflow automation.

OnPay offers an employee portal where employees may update information, onboard new employees, and view previous pay stubs and tax forms. Businesses may keep track of their workers’ paid time off, vacation, and sick leave.

The system includes a document vault where contracts and employee notes may be stored. It integrates with third-party programs such as Xero, QuickBooks, Guideline, Humanity, Kabbage, etc.

It is a simple, low-cost online payroll system suited for small businesses. There are no hidden costs, which is critical for a small firm on a tight budget.

Your federal, state, and local payroll taxes are calculated and filed automatically by the full-service payroll.

Another employee management option provided by OnPay is 401(k) planning, which assists employees in planning for retirement.

Features of OnPay

Here are some of the interesting features of OnPay payroll.

- Error-free full-service payroll

- Automated tax payment

- Employee self-onboarding

- User and mobile-friendly.

- Integrates with Xero and QuickBooks

- Online employee portal and lifetime accounts for employees.

- Unlimited pay runs and expert help

Benefits of OnPay

- There are no hidden costs.

- Simple to use

- Excellent value for money.

- It has a facility of direct deposit on employees.

- Response time is super quick.

Drawbacks of OnPay

- There will be no same-day or next-day direct deposits.

- There is no automated payroll submission.

Pricing of OnPay

- It offers a simple plan which costs a $36 base fee + $4 per person.

Availability: Windows, Mac, Android, web Browser

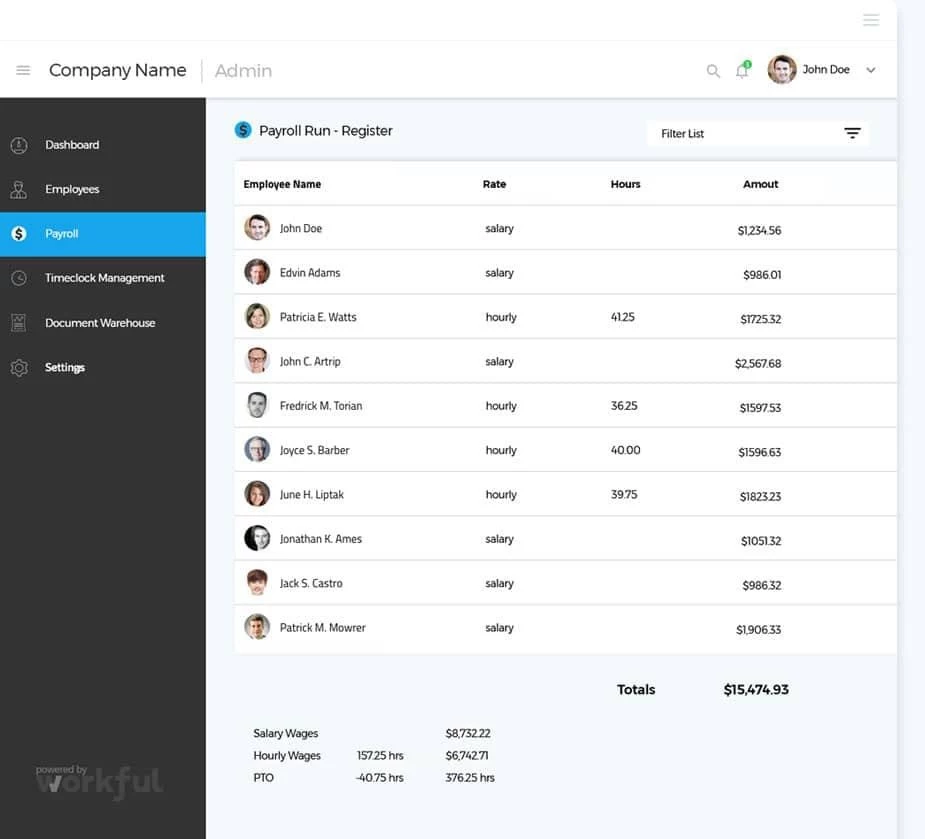

Workful

Workful is a web-based payroll and employee management tool that helps small businesses automate internal communication, time tracking, onboarding, and other operations.

It is one of the younger online payroll systems on the market, and it’s already building a reputation for itself with its excellent customer service.

The geolocation time-clock tracking is simple to set up and guarantees that employees clock in and out from the place they choose.

HR teams that use Workful can save key papers like expenditure rules, employee handbooks, and day-to-day rules in a centralized repository for future reference.

The centralized platform manages time-off requests and maintains employee calendars, allowing employees to monitor their PTO balance quickly.

Features of Workful

Some of the best features of Workful payroll are as follows:

- Free direct deposit

- Unlimited payroll runs

- State and federal tax forms

- QuickBooks integrations

- Electronic paystubs

- Benefits deduction and check printing

Benefits of Workful

- Reasonably priced

- Simple to use

- Employee spending tracking is included.

- Provides time-clock geolocation tracking

- Document storage is included.

Drawbacks of Workful

- Tax filing is not available in every state.

- Reporting features are limited.

- The setup appears to be clumsy.

Pricing of Workful

- It offers $25/month + $5/employee/month.

Availability: Windows, Mac, Android, web Browser

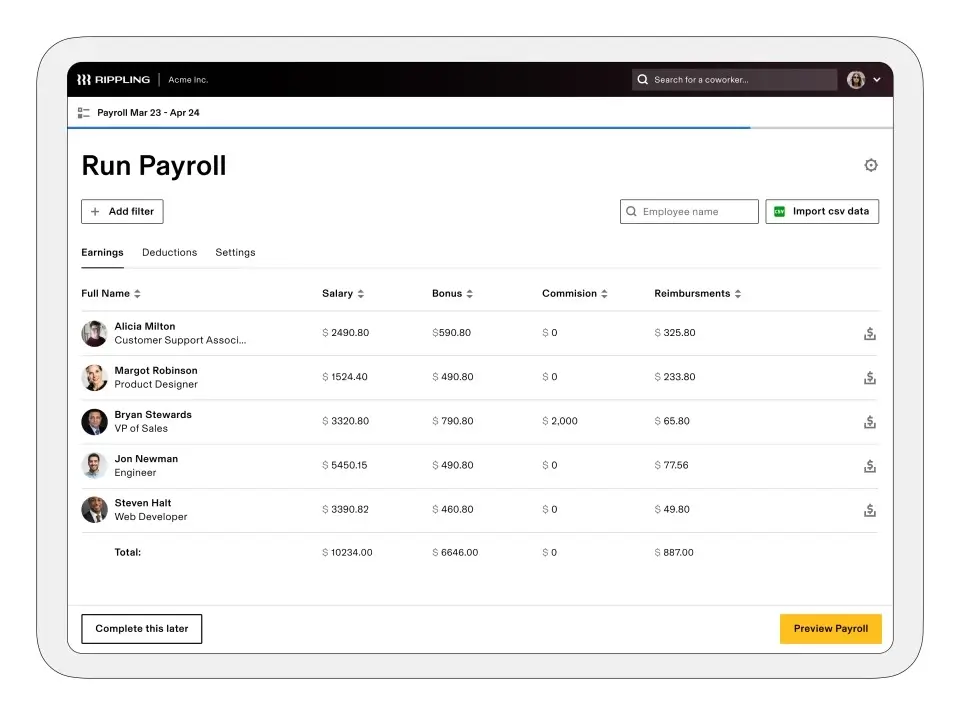

Rippling

Rippling payroll is a module of Rippling’s HR platform that offers versatile capabilities for efficient payroll processing.

There is no need to manually enter employee time data because it syncs with Rippling’s other modules and third-party apps.

It can pay workers and contractors regardless of their location, a mobile app for viewing paychecks and requesting time off, and the ability to handle organizations with numerous EINs.

Rippling wins a spot on our list due to its easy integration with almost any program you already use. It is easier and faster to process payroll when all of your data is immediately synced.

Rippling payroll also connects with SMB and enterprise accounting solutions (such as QuickBooks, Xero, NetSuite), so expense data is routed directly to those systems.

Rippling also offers a mobile app that allows employees to receive push notifications about their paychecks, manage their leave balance, and request time off their phones.

Features of Rippling

Here are some of the core features of Rippling payroll.

- All-in-One Human Resources Platform (HRIS)

- Administration of Benefits

- Contractor administration.

- Onboarding and offboarding of employees

- HR and IT Reporting at the Enterprise Level

- Payroll & Tax Filing as a Full-Service Provider

- Tracking of Time and Vacation.

Benefits of Rippling

- Small businesses can afford it.

- Pay employees from any location in the world

- Integrate with over 500 applications

- Automatic reporting makes it easier to remember special days.

- It makes onboarding easy

- Simple and easy to use.

Drawbacks of Rippling

- The pricing structure is confusing

- Time and attendance have some issues.

Pricing of Rippling

- It starts with $8/month/user.

Availability: Windows, Mac, Android, web Browser

ADP

Automatic Data Processing or ADP is one of the most extensive human resources (HR) software solutions and outsourced services globally.

ADP has been in the market for more than 70 years and is one of the major payroll service providers.

ADP provides a broad range of services, including payroll processing, payroll taxes, accounting integrations, new-hire reporting, and HR services, making it an excellent choice for firms with complicated requirements.

Because of the brand recognition and years of expertise, it is great for large businesses or organizations that expect to develop quickly.

Full-service payroll, direct deposit, reporting, and a self-service employee portal are included in the lowest-priced package. Higher-priced plans provide more features and HR services.

ADP has traditionally been a professional employer organization (PEO), but it has developed a payroll solution tailored to small businesses.

Features of ADP

Here are some of the best features of ADP.

- Federal and state tax forms.

- New hire reporting

- They are integrated with account software such as QuickBooks and Xero.

- Payroll reports and compliance

- Time tracking and HR services

- Good customer service

- Mobile app

Benefits of ADP

- Intuitive and easy to use.

- Scalable with a variety of plan choice

- Reporting that is robust and customizable

- There are several HR add-ons.

- It reduces labor costs via better workforce management.

- Automated payroll processes

Drawbacks of ADP

- Pricing is not made clear.

- For small businesses, there may be too many features.

- There are several costs, including one for setup.

Pricing of ADP

It does not provide detailed pricing plans. But, it offers the following plans:

- Basic Plan: $10/month/user

- Advanced Plan: $23/month/user

Availability: Windows, Mac, Android, web Browser

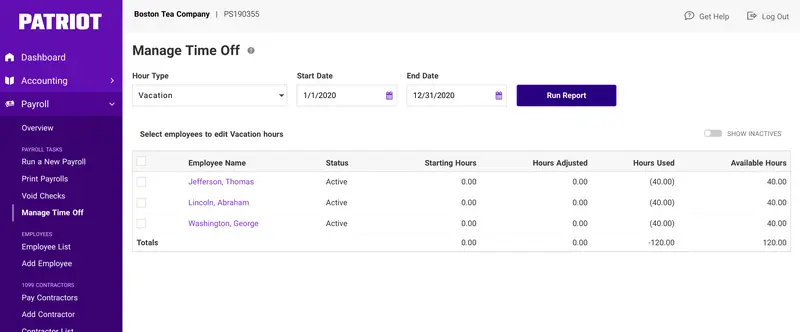

Patriot Payroll

Patriot Payroll is a human resource (HR) and payroll management solution by Patriot Software that helps streamline the many procedures connected with handling payroll payments and tax filings.

The system includes keeping payroll records, printing checks, setting up direct transfers into bank accounts, generating payroll reports, and filing state and federal taxes.

Patriot Payroll allows you to issue payrolls via direct bank transactions and electronic checks. Employees may access their payroll and related financial information through personalized portals provided by the software.

The reporting functionality of the application assists employees in generating year-end reports and printing W2 forms for tax filing.

Patriot Payroll is built for small companies with 1-100 employees and supports clients in various jobs, including distribution, retail, engineering, maintenance/field service, and more.

Features of Patriot Payroll

Some of the core features of Patriot payroll are as follows:

- Payroll processing

- Invoice management

- Tax calculations with end-year reporting

- Accounting and reporting

- Time and attendance

- Core HR

- Time-off tracking

Benefits of Patriot payroll

- Calculates tax automatically with payroll processing.

- Easy to use

- Scalability and better security.

- Affordable and transparent cost

Drawbacks of Patriot payroll

- No customizable report.

- It uses additional fees.

Pricing of Patriot payroll

It offers two different plans.

- Basic: $10/month plus $4/person.

- Full service: $30/month plus $4/person.

Availability: Windows, Mac, Android, web Browser

Conclusion

In conclusion, different apps for payroll management are used for all-size businesses with accessible or affordable costs.

We have provided you with numerous payroll management software with detailed information above. Now it’s your time to choose any software from above according to the size of your company’s team members, project, and budget.

You can download any apps on any platform and get started for free. Please let us know in the comment section below if you have any queries.

in Melbourne

in Melbourne

Employee Screen Monitoring Software

Employee Screen Monitoring Software App and Website Monitoring Software

App and Website Monitoring Software Time and Attendance Software

Time and Attendance Software Finance

Finance Banking

Banking Healthcare

Healthcare Lawyers

Lawyers Retail & ecommerce

Retail & ecommerce Knowledge base

Knowledge base Blogs

Blogs Installation Guide

Installation Guide FAQs

FAQs About

About Media Kit

Media Kit Contact us

Contact us